Do you find yourself without any money to spare once your bills are paid each month? If so, you’re one of the millions of U.S. residents in the same boat. Living paycheck to paycheck is frustrating and stressful — and overwhelmingly common. Between the rising costs of living and wage growth that fails to keep up, a high number of people don’t have enough savings to spend on recreation or to support them through tough times.

How Many Americans Live Paycheck to Paycheck?

Exactly how many Americans are living paycheck to paycheck, you ask? Different studies report different statistics, and most of them say it’s over 50% of the U.S. population.

According to Magnify Money, 53% of respondents live paycheck to paycheck, and 62% don’t have at least three months of savings to hold them over.

CNBC reports that 63% of 2,000 survey participants are living paycheck to paycheck since the beginning of the COVID-19 pandemic. This is unsurprising, especially because millions of people lost their sources of income while bills didn’t cease.

However, CareerBuilder notes that a staggering 78% of American workers were living paycheck to paycheck in 2017. It’s not just people close to or below the poverty line, either — almost one in 10 workers who earn at least $100,000 annually are also in a tight spot.

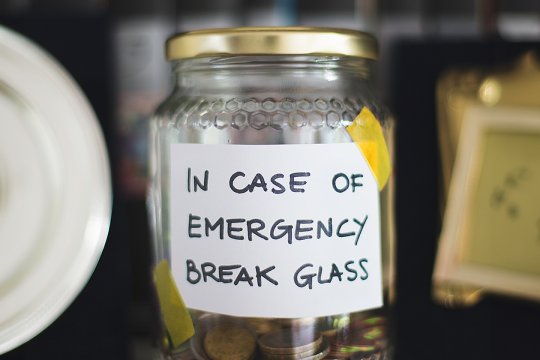

The number of participants, recent government shutdowns, COVID-19, and other factors influence each study. Still, a pattern is consistent: if you want to know how many people live paycheck to paycheck in the U.S., the answer is that a significant portion of the population is one disaster away from poverty, unmanageable debt, and even homelessness.

Why Is This the Case?

How did the situation get so dire? One of the most substantial reasons is rising living costs. Housing, food, utilities, transportation, gas, healthcare, education, and many other essentials are dramatically more expensive than they used to be.

For example, a new house in January 2000 cost $194,800 on average, equivalent to $297,705 today when adjusted for inflation. However, the average price of a new home in January 2020 was a whopping $402,400 — greater than 35% higher, even after considering inflation.

To make matters worse, wages aren’t maintaining an equal pace. The country’s predicament wouldn’t be as dangerous if people earned a proportionate amount of money, but PayScale reports that “real wages” (wages adjusted for inflation) have fallen 8.5% since 2006. With Americans earning less but having no choice but to spend more, they have nothing left over for savings or emergencies and feel forced to take on more debt.

What Can People Do to Get By?

To stop living paycheck to paycheck, the obvious but unhelpful answer is “make more money.” If you don’t have a higher-earning job lined up but want to improve your financial situation as soon as possible, here are a few pieces of advice for managing and avoiding extra debt:

Consolidate Your Debt

If interest rates are a drain on your wallet, then something you can do to save money is to consolidate your debt in the form of a personal loan. With all of the various debts and expenses you are paying, such as medical bills, rent, credit card statements, student loans, and more, it’s challenging to manage them all when they have different rates and deadlines. Roll your debts into a single monthly payment so you can keep better track and pay it off consistently.

Start a Side Hustle

It’s understandable if you don’t have the time for a side hustle after working a 40+ hour week. If you have the time and energy, though, then starting a side-gig is a convenient way to make extra money. You could drive for a rideshare service, perform lawn care, babysit, start a dropshipping business, deliver food, or sign up for odd jobs in your neighborhood through TaskRabbit.

Avoid Excess Fees

Fees are likely another significant weight on your finances. They accumulate more than you realize, and without them, you’d have more money to put into savings. Learn what fees you are paying and take measures to avoid them. For example, sign up for low balance alerts, so know not to spend anymore before paying an overdraft fee. Only use your bank’s branded ATMs to avoid withdrawal charges. Be patient when depositing money with PayPal and wait three days so you don’t pay a transfer fee. If late fees are a frequent issue because your bills’ deadlines don’t align with your paycheck’s schedule, then you can use Earnin to pay them on time, and you only tip what you think is fair.

Save What You Can

If you’re already living below your means, then you might be tempted to spend your leftover cash on unnecessary things. Instead, put whatever you can afford into savings you have an emergency fund that will prevent you from returning to living paycheck to paycheck if a disaster sets back your progress.

When you inquire how many Americans live paycheck to paycheck, the answer is rarely optimistic. It would take a tremendous reform of our financial system to reduce the number to zero, but in the meanwhile, you can take steps to build savings (aim for at least six months’ worth) and minimize your debt.

Photo by Sharon McCutcheon on Unsplash

Please note, the material collected in this blog is for informational purposes only and is not intended to be relied upon as or construed as advice regarding any specific circumstances. Nor is it an endorsement of any organization or Services.

You may enjoy

EarnIn is a financial technology company not a bank. Subject to your available earnings, Daily Max and Pay Period Max. EarnIn does not charge interest on Cash Outs. EarnIn does not charge hidden fees for use of its services. Restrictions and/or third party fees may apply. EarnIn services may not be available in all states. For more info visit earnin.com/TOS.